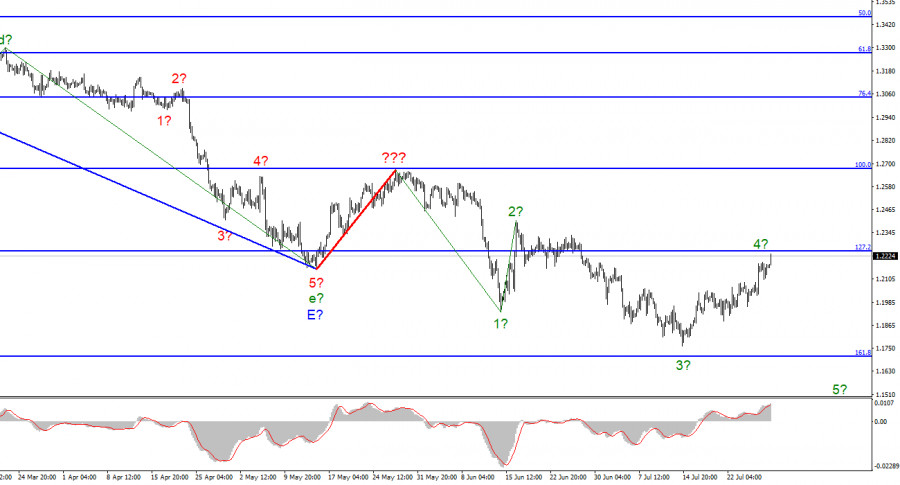

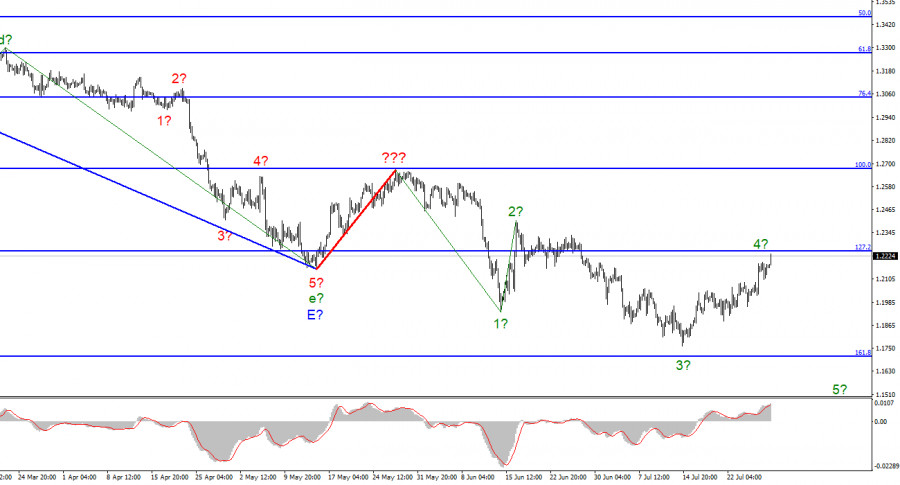

For the pound/dollar instrument, the wave marking at the moment looks quite difficult, but does not require adjustments. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, we can say that the construction of the upward correction section of the trend is canceled, and the downward section of the trend will take a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a strongly lengthening trend area. Identifying rare corrective waves would be much more expedient, after which new impulse structures will be built. We have completed waves 1, 2, and 3, so we can assume that the instrument is now in the process of building wave 4 (which may also be already completed or nearing completion). The wave markings of the euro and the pound are slightly different in that, for the euro, the downward section of the trend has an impulse form (for now). But the ascending and descending waves alternate almost equally. I expect a new decline in the British dollar in the coming days.

The mark of 1.2250 stopped the controversial growth of the British

The exchange rate of the pound/dollar instrument increased by 75 basis points on July 29, but by the time of writing the article, it had lost the same amount. Thus, today is still passing without a clear market mood. I consider the main event of Friday to be an unsuccessful attempt to break through the 1.2250 mark, which corresponds to 127.2% Fibonacci. Wave 4 (if this is it) has taken on a more extended form than I expected, but now it can already be completed. The latest increase in the instrument could be due to a weak report on US GDP in the second quarter, which became available yesterday afternoon. However, I have already questioned the validity of the increase in demand for the pound in recent days. Despite the weak data on US economic growth, I believe it is high time for the pound to start building a new downward wave 5.

By the way, now is the time to analyze the results of the FOMC meeting finally, or rather how the market perceived them. Although the rate was raised by 75 basis points and almost promised to be raised again by 75 points in September (especially if inflation does not slow), demand for the US currency has been declining this week, which looks quite strange. So maybe the same thing awaits us next week when the Bank of England announces a similar decision? The British central bank also intends to raise the interest rate, and many analysts believe it is stronger than in previous times. That is, by 50 basis points. Maybe this is the decision that the market is playing back now? After a similar decision by the Fed, the US currency fell. I believe that next week we are waiting for a new decline in the British dollar in any decisions that the Bank of England will make.

General conclusions

The wave pattern of the pound/dollar instrument suggests a further decline. Thus, I advise now selling the instrument with targets near the estimated mark of 1.1708, which is equivalent to 161.8% Fibonacci, for each MACD signal "down." An unsuccessful attempt to break through the 1.2250 mark and the departure of quotes from the reached highs indicates that the market is not ready to continue buying the British pound.

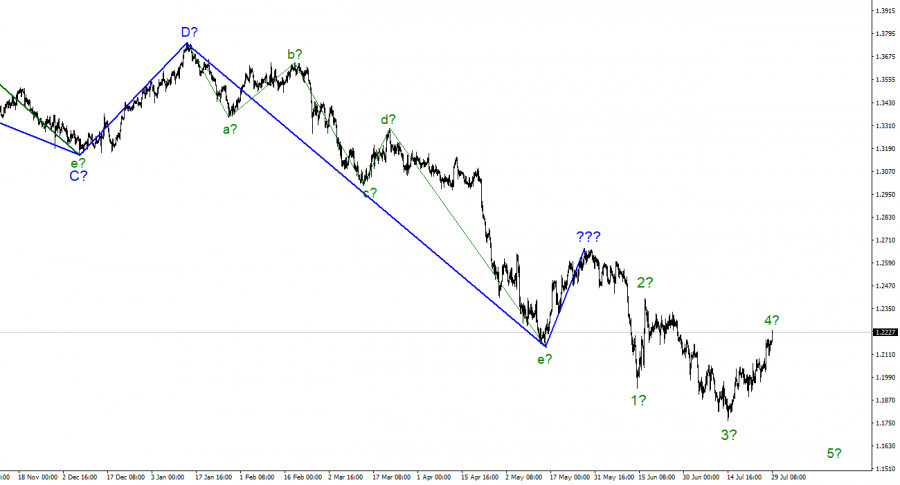

The picture is very similar to the Euro/Dollar instrument at the higher wave scale. The same ascending wave is unsuitable for the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.