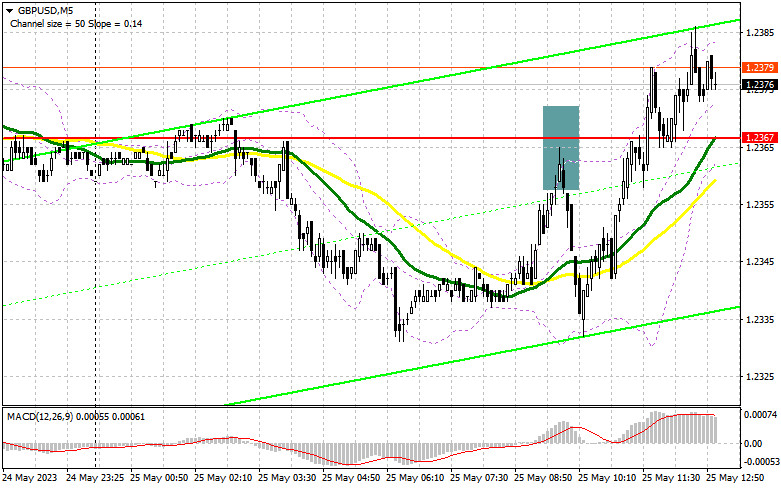

In my morning forecast, I drew attention to the level of 1.2367 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The rise and formation of a false breakout led to a sell signal, resulting in a decline of the pair by more than 30 points. The technical picture was completely revised in the second half of the day.

To open long positions on GBP/USD, the following is required:

Figures on changes in US GDP for the first quarter of this year and a sharp increase in the number of initial jobless claims would improve the situation for the British pound, which cannot stop its decline against the US dollar.

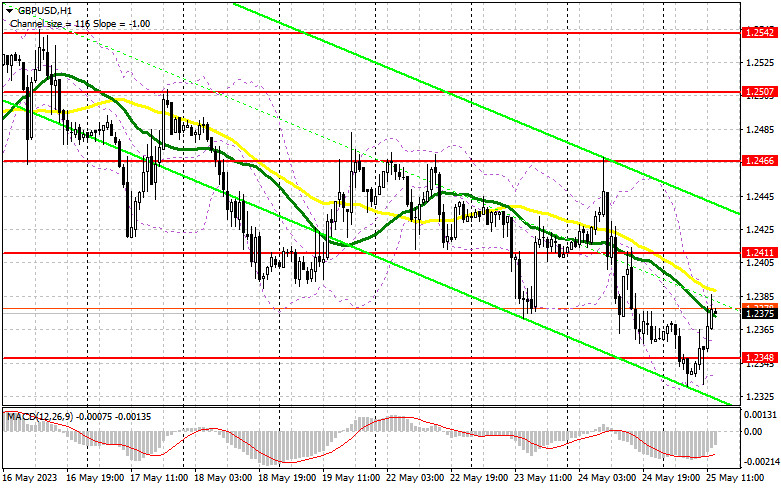

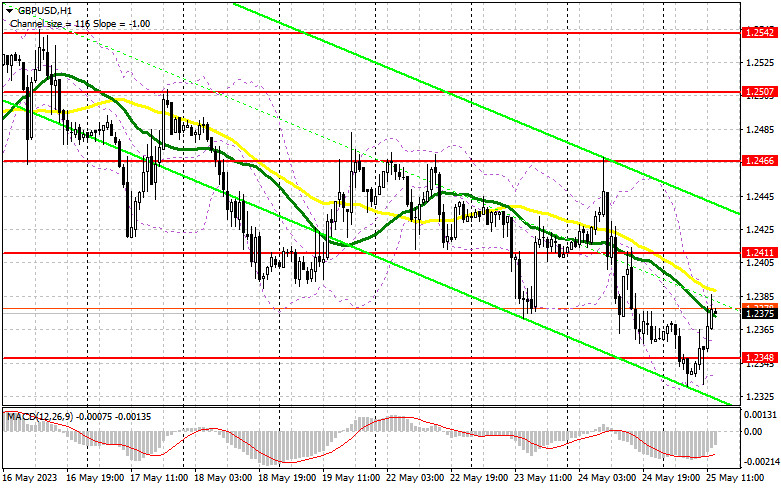

However, I will continue to act only on the downside, as going against the bearish market is not the best idea. Only after the formation of a false breakout around the new support level of 1.2348 can we expect a buying opportunity, which will lead to a surge in the pair towards 1.2411. A breakthrough and a reverse test of this range from top to bottom will provide an additional signal to open long positions and strengthen a bullish presence with a surge toward 1.2466. The ultimate target will be the area of 1.2507, where I will take profit. In the scenario of a renewed decline toward monthly lows and a complete lack of activity from buyers at 1.2348, I will postpone purchases until the next update of the monthly low at 1.2310. I will also open long positions there only on a false breakout. I plan to buy GBP/USD immediately on a rebound only from the minimum at 1.2275, with a 30-35 point correction target within the day.

To open short positions on GBP/USD, the following is required:

Sellers attempted to continue the trend, but it didn't work well. They need not miss the new resistance level at 1.2411, formed based on yesterday's results. That's where I expect the participation of major players. A false breakout at 1.2411 with a decline target towards the support at 1.2348 will be an attractive selling scenario. A breakthrough and a reverse test of this range from bottom to top will strengthen the bearish trend, forming a signal to open short positions with a drop towards 1.2310. The ultimate target remains the minimum at 1.2275, where I will take profit.

In the event of an increase in GBP/USD and a lack of activity at 1.2411, we may see stop orders of sellers being taken out and the formation of an upward correction for the pair. In that case, I will postpone selling until a test of the resistance at 1.2466, from where the pound has fallen nicely this week. A false breakout there will be the entry point for short positions. If there is no downward movement from 1.2466, I will sell GBP/USD on a rebound from 1.2507, but with the expectation of a 30-35 pip correction within the day.

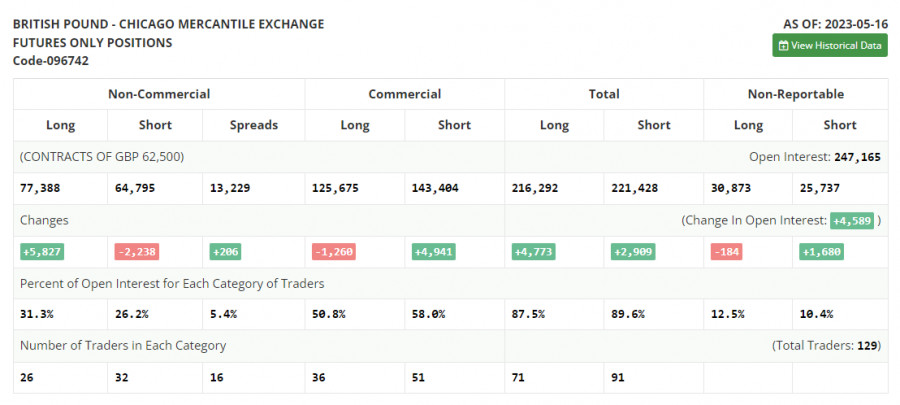

The COT report (Commitment of Traders) for May 16 showed an increase in long positions and a decrease in short positions. The correction of the British pound was quite significant, and the pair is trading at very attractive prices, which is reflected in the report. Once the issue of the US debt ceiling is resolved, the demand for risk assets will return, and the pound will be able to recover quite substantially. Remember that the Federal Reserve plans to pause its interest rate hike cycle, which will also pressure the US dollar. In the latest COT report, it is mentioned that short non-commercial positions decreased by 2,238 to 64,795, while long non-commercial positions jumped by 5,827 to the level of 77,388. This led to an increase in the non-commercial net position to 12,593 from 4,528 a week earlier. The weekly closing price decreased to 1.2495 from 1.2635.

Indicator Signals:

Moving Averages

Trading occurs below the 30-day and 50-day moving averages, indicating a continuation of the bearish market.

Note: The period and prices of the moving averages considered by the author are based on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In case of an increase, the upper boundary of the indicator around 1.2370 will act as resistance.

Description of Indicators:

• Moving Average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

• Moving Average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

• MACD (Moving Average Convergence/Divergence) indicator. Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The net non-commercial position is the difference between non-commercial traders' short and long positions.