The GBP/USD currency pair traded with great tranquility on Thursday until the Bank of England meeting concluded. Recall that we have consistently mentioned in recent articles that traders have anticipated a likely rate increase of 0.5 percent for quite some time and that the pound has strengthened significantly over the past few weeks compared to the euro. Therefore, it was extremely tough to watch the pair continue to grow. We were essentially correct about this. As soon as BA revealed its decision to increase the rate by 0.5 percentage points, the pound plummeted. Now, it is prudent to wait until the middle of Friday so that all traders have time to analyze the meeting's outcome, as the reaction to such a significant event can have a lasting impact on market sentiment for several weeks. In the interim, the pound sterling has stabilized below the moving average line. Therefore, the upward trend can be deemed momentarily to have ended.

We have stated for quite some time that we anticipate a resumption of the worldwide downward trend in the pound, as we do not see any justification for higher growth than what has been demonstrated in recent weeks. Yes, the Bank of England has raised rates six times in a row, accelerating the pace of monetary policy tightening. However, it continues to lag behind the Fed, increasing the rate more quickly and aggressively. Also, the pound remains a dangerous currency, which is why the US dollar is chosen in times of difficulty. And it isn't easy to find more trying times than the present. We have already stated that three new "hot spots" simultaneously appeared on the world's geopolitical map within the past week. They began firing on the Serbian-Kosovo border; Azerbaijan and Armenia began firing in Nagorno-Karabakh; and China began military maneuvers surrounding the island of Taiwan, which incensed the Chinese rulers, who believed the island to be theirs. It is currently extremely difficult to predict how these new wars will conclude. But if the situation worsens, the euro and pound will face increased pressure.

The Bank of England did not attempt to calm the financial markets.

The Bank of England's primary decision to increase the benchmark rate by 0.5 percentage points did not come as a complete surprise. The nine financial committee members voted unanimously to increase the rate by this exact amount. Here, everything is obvious. The market was then flooded with information that left no one unmoved. The Bank of England has increased its inflation projections. Previously, it anticipated a maximum inflation rate of 10 to 11 percent in 2022; presently, 13 percent is being discussed as the highest inflation rate since 1980. Second, BA predicted that inflation would remain elevated for the upcoming year, with a return to the target level not anticipated for at least two years. Third, the regulator predicted that the British economy would enter its most severe recession since the global financial crisis by the end of 2022. Unlike the Federal Reserve, the regulator thinks it will last for five quarters and does not even attempt to refute it.

What conclusions are possible? As is customary, the central bank's projections can be safely multiplied by 1.5. First, if the regulator anticipates an inflation rate of 13 percent, the actual rate will be 15 to 16 percent. Second, if the regulator proclaims a recession to last five quarters, it will endure 7-8. Third, if inflation is anticipated to return to the target level in two years, it will return in three years. After the meeting, Mr. Bailey stated that the fight against rising inflation is the regulator's top concern and that the Russian-Ukrainian conflict has a terrible effect on the world economy. The longer it continues, the worse it becomes. Thus, we have witnessed multiple resonant pronouncements concurrently, which will undoubtedly assist traders in understanding the prognosis for the British pound in the following weeks/months.

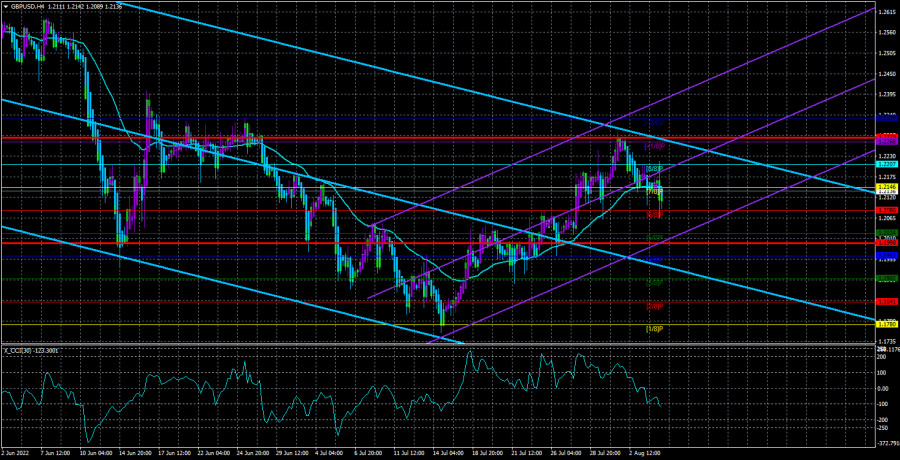

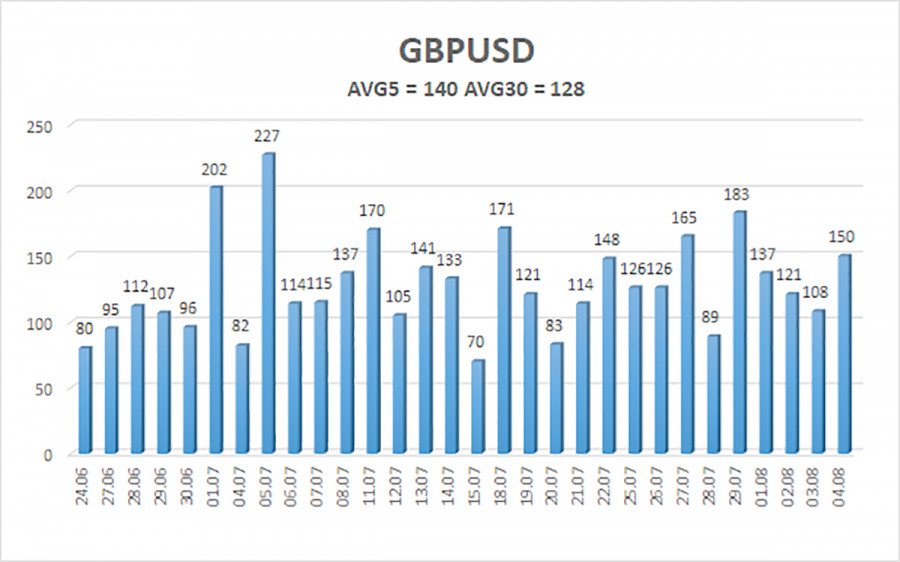

During the last five trading days, the average volatility of the GBP/USD pair was 140 points. This value for the pound/dollar combination is "high." Therefore, on Friday, August 5, we anticipate price action within the channel, bounded by the levels of 1.1998 and 1.2279. A reversal of the Heiken Ashi indicator to the upside may imply a continuation of the upward trend.

Nearest support levels:

S1 – 1.2085

S2 – 1.2024

S3 – 1.1963

Nearest resistance levels:

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Recommendations for Trading:

The GBP/USD pair has consolidated below the 4-hour moving average. Before the Heiken Ashi indicator goes upwards, sell orders with targets of 1.2024 and 1.1998 should thus be considered at this time. When fixing above the moving average line, buy orders should be placed with targets of 1.2207 and 1.2209.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel that the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.