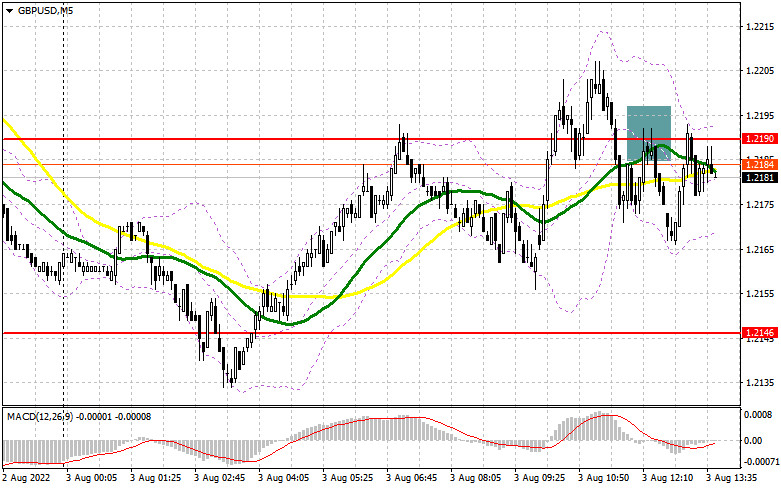

In my morning forecast, I paid attention to the level of 1.2190 and recommended deciding on entering the market. Let's look at the 5-minute chart and figure out what happened there. Weak PMI reports did not allow pound buyers to break above 1.2190. All attempts to gain a foothold at 1.2190 only led to the pair returning to this level, eventually allowing us to get a sell signal. But even then, there was no major downward movement. They fell by only 25 points, although hope remains – reports on the American economy are ahead. From a technical point of view, nothing has changed for the day's second half, and the strategy itself has not changed.

To open long positions on GBP/USD, you need:

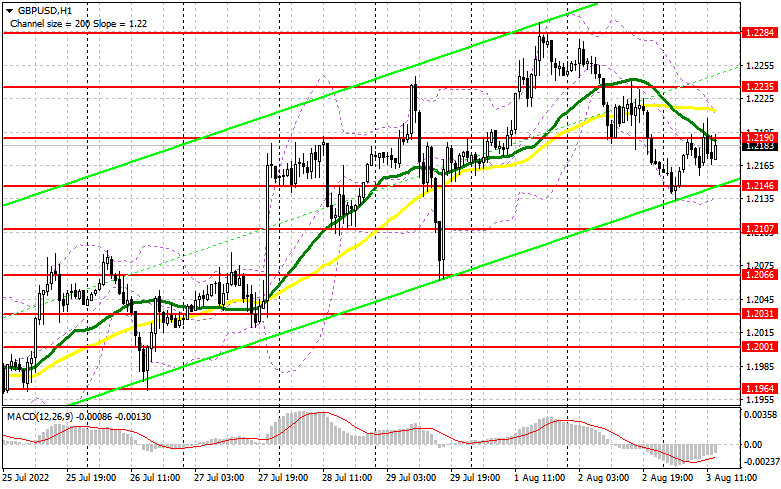

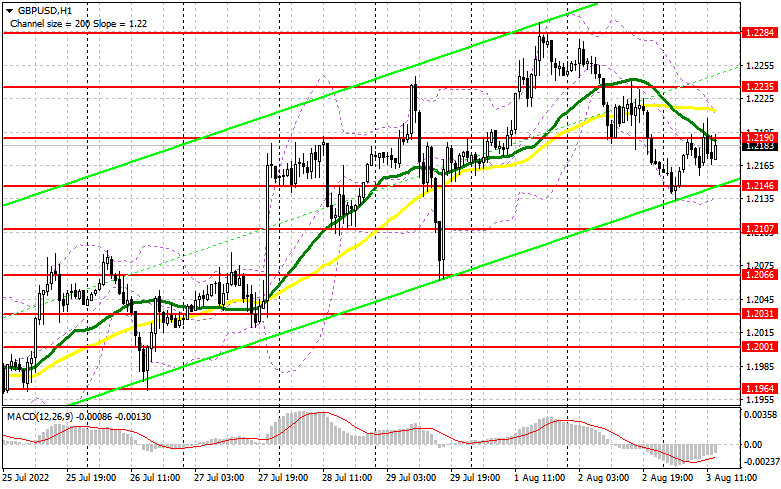

Geopolitical tensions have slightly decreased as China has failed to oppose the United States and has completely accepted the provocation on their part. Therefore, in the afternoon, I advise you to shift the focus to data on the American economy. Reports on the business activity index in the services sector and the composite PMI index are expected. Only a strong positive discrepancy with the forecasts of these indicators will put pressure on the pound, since there is no other weighty reason to sell GBP/USD yet. The optimal scenario for buying remains a false breakdown in the area of the nearest support of 1.2146. In this case, you can count on a new spurt of the pair up to 1.2190, near which the pair spent the entire first half of the day, so a breakdown of this level will open the way to the 1.2235 area, just below which the moving averages are playing on the sellers' side. A more distant goal will be this month's maximum of 1.2284, where I recommend fixing the profits. If GBP/USD falls and there are no buyers at 1.2146, the pressure on the pound will seriously increase, forcing the bulls to take profits, as the upward trend will be broken. If this happens, I recommend postponing long positions to 1.2107. I advise you to buy there only on a false breakdown. It is possible to open long positions on GBP/USD immediately for a rebound from 1.2066 or even lower – around 1.2031 with the aim of correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

Selling the pound is getting more complicated, so be careful and keep an eye on the level of 1.2190. While trading is below this range, I expect a decline in GBP/USD. As soon as we miss it, the bulls will take control of the market. The optimal scenario for opening short positions will be another false breakout in the area of 1.2190. It will return the pressure on the pound to reduce to the nearest support of 1.2146, formed at the end of the Asian session. A breakout and a reverse test from the bottom up of this range will give an entry point to sell with a drop to 1.2107, and a more distant target will be the 1.2066 area, where I recommend fixing the profits. With the option of GBP/USD growth and the absence of bears at 1.2190 in the afternoon, which most likely will be the case, bulls will have a ghostly chance to save the situation, but the risk of increased geopolitical conflict will limit the upward potential. In this case, I advise you not to rush with sales. Only a false breakout near the maximum of 1.2235 will give an entry point to short positions in the expectation of a rebound of the pair. There may be a jump up to the monthly maximum if there is no activity. With this option, I advise you to postpone short positions to 1.2284, where you can sell GBP/USD immediately for a rebound, counting on the pair's rebound down by 30-35 points within a day.

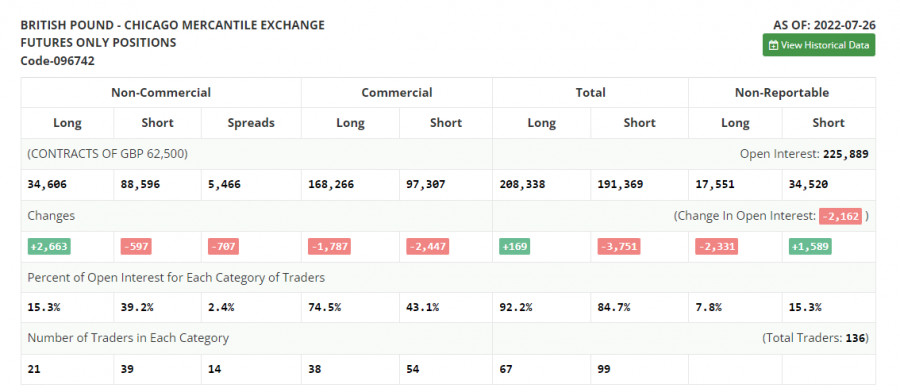

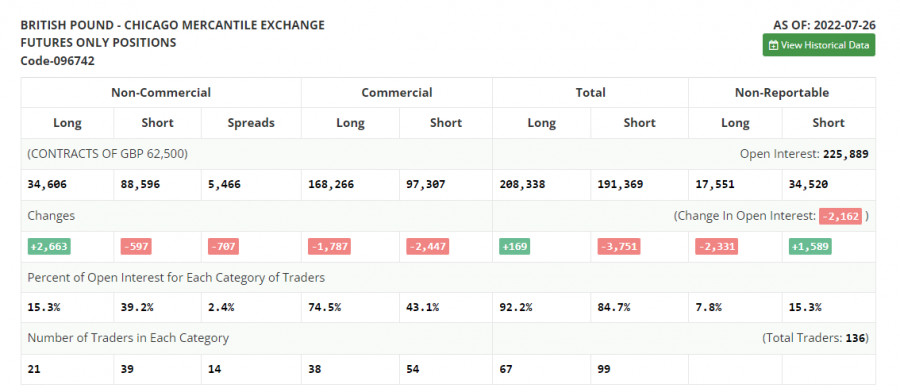

The COT report (Commitment of Traders) for July 26 recorded a reduction in short positions and a sharp increase in long ones, which coincides with what we are currently seeing in the market. The British pound is in active demand, and there is no doubt that the Bank of England will continue to raise interest rates this month. The aggressive policy of the regulator has a positive effect on the British pound, even though the economy is not in the best condition. The decision of the US Federal Reserve last week to raise interest rates in the fight against high inflation will affect the future decision of the Bank of England. However, it is worth saying that the demand for the pound is not as serious as it might seem. The upward movement of GBP/USD is taking place against a weakening dollar, as traders have received a clear signal that the US Central Bank may soften its interest rate hikes in the fall. But even against this background, it is not rational to wait for a further bull market for the pound, given the cost-of-living crisis in the UK and the economy gradually slipping into recession. The COT report indicates that long non-commercial positions increased by 2,663 to 34,606. In contrast, short non-commercial positions decreased by 597 to the level of 88,596, which led to a decrease in the negative value of the non-commercial net position to the level of 53,990 from the level of -57,250. The weekly closing price rose to 1.2043 against 1.2013.

Signals of indicators:Moving AveragesTrading is conducted below the 30 and 50-day moving averages, indicating bears' attempt to build a downward correction of the pair.Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.Bollinger BandsIn case of a decline, the lower limit of the indicator in the area of 1.2145 will act as support. In the case of growth, the upper limit of the indicator in the area of 1.2200 will act as resistance.Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.