Long positions on USD/JPY:

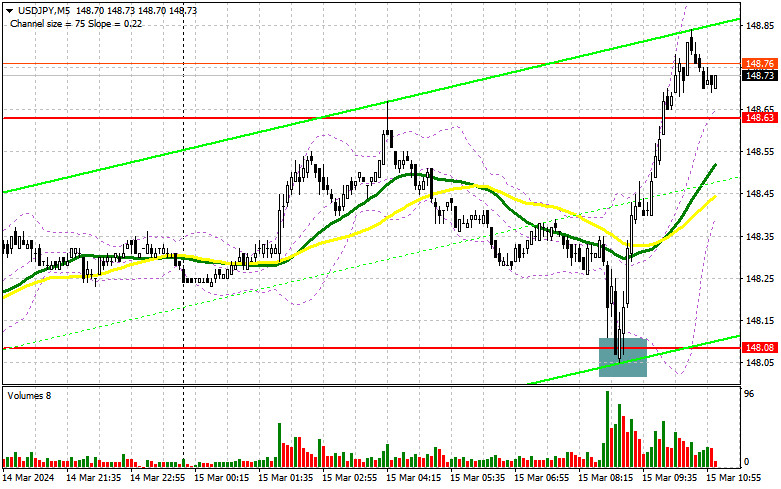

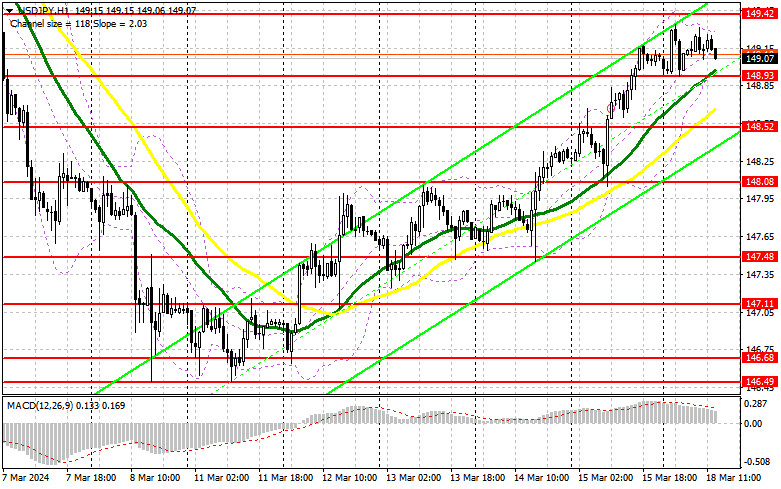

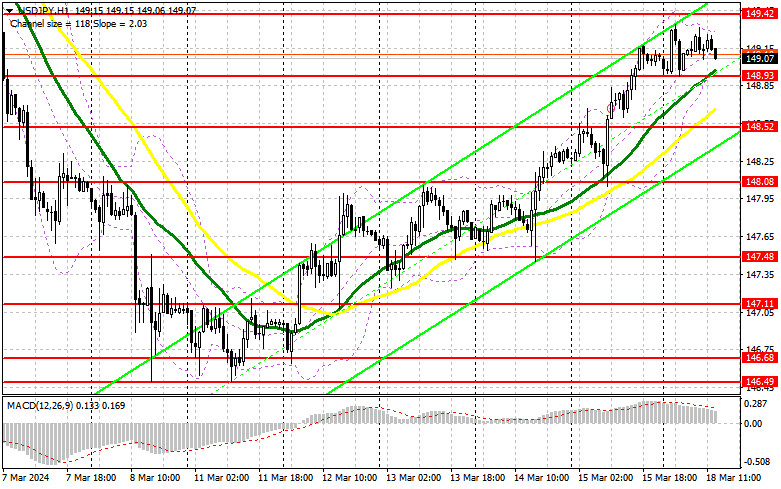

The US data continues to revive demand for the US dollar, while the procrastination of Japanese officials with news on monetary policy, as has happened before, puts pressure on the Japanese yen. In the latter half of the day, there are no significant economic indicators, so nothing will spoil buyers' sentiment. I still prefer to act in a bullish market after a decline and the formation of a false breakout. The nearest support at 148.93, where the moving averages are located, will be an excellent level for this. The growth target is the resistance at 149.42, which the pair has not yet reached today. A breakthrough and consolidation above this range will allow buyers to strengthen their positions in the market, giving a chance to open long positions with a target of 149.85. The next target is the high at 150.21, where traders can take profits. In the scenario of a decrease in the pair and the absence of activity at 148.93 on the part of buyers in the second half of the day, pressure on the pair will likely return. In such a case, I will try to enter the market near 148.52 on a false breakout. There will be a suitable condition for opening long positions. I plan to buy the pair on a rebound only from 148.08, allowing an intraday correction of 30-35 pips.

Short positions on USD/JPY:

Sellers also have chances to strengthen in the market, but this requires weak US statistics and the defense of the nearest resistance at 149.42. A false breakout there will provide a good entry point for selling with a move to 148.93 – the support formed as of today. A breakthrough and a reverse test from below of this range will deal a more serious blow to positions of bulls, leading to the execution of stop orders and opening the way to 148.52. The next target is the area of 148.08, where I plan to take profits. In the bullish scenario and the absence of bearish activity at 149.42 in the second half of the day, which will happen if there is another batch of strong US statistics, the market will continue the bullish stage. Therefore, it is better to postpone sales until the pair reaches the resistance at 149.85. In the absence of a downward movement there, I will sell the pair on a rebound from 150.21, allowing an intraday correction of 30-35 pips.

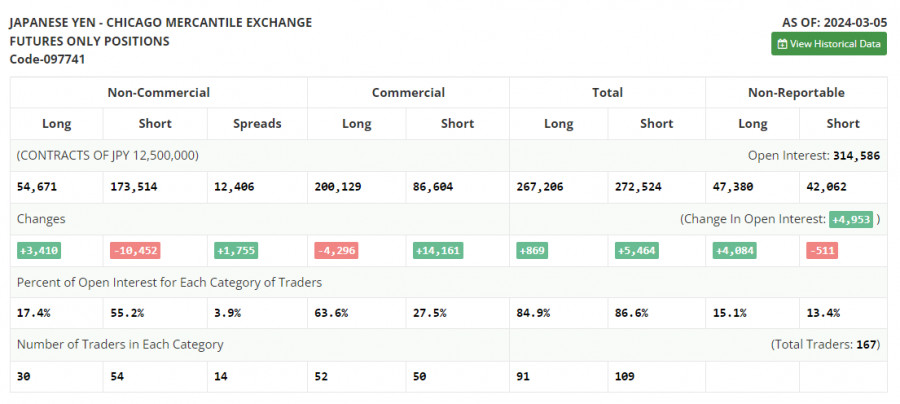

In the COT report (Commitment of Traders) for March 5, there was an increase in long positions and a sharp reduction in short positions. In the current realities, when the Bank of Japan has seriously spoken about the need to make changes to the current policy, the increase in long positions on the yen is not surprising. Many traders expect adjustments to monetary policy as early as March this year, which will continue to support demand for the risky asset. However, do not forget about the policy of the Federal Reserve, which currently relies on inflation data. A new batch of statistics is expected soon, so the dollar may significantly improve its position in the market. The latest COT report states that non-commercial long positions increased by 3,410 to 54,671, while non-commercial short positions decreased by 10,452 to 173,514. As a result, the spread between long and short positions increased by 1,755.

Indicator signals:

Moving averages

Trading is conducted above the 30 and 50-day moving averages, indicating further growth of the pair.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decrease, the lower boundary of the indicator around 148.93 will act as support.

Indicator descriptions

- Moving average determines the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average determines the current trend by smoothing out volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence) Fast EMA 12. Slow EMA 26. SMA 9

- Bollinger Bands. Period 20

- Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.