The euro-dollar pair ended the trading week at 1.0183. Despite high-profile events of a geopolitical and macroeconomic nature, the price has not left the established price range of 1.0120-1.0280, within which it has been fluctuating since July 19. EUR/USD traders did not dare to make a downward breakthrough, while there were no grounds for a trend reversal to the upside, and there are none. Corrective surges are caused by the greenback's behavior, which sometimes "gives up slack" due to increased risk sentiment. But in general, EUR/USD bears continue to keep their finger on the pulse: they open short positions as soon as the pair crosses 1.0250. Thus, they extinguish the upward momentum, preventing the bulls from developing a corrective price growth.

The first week of August turned out to be "hot" in every sense. The resonant visit of the speaker of the lower house of Congress to Taiwan overshadowed all other fundamental factors. Millions of people followed the flight path of the American Air Force 3, discussing the possible consequences of Nancy Pelosi's visit to the island, which China considers its rightful territory. By the way, officially the United States remains committed to the policy of a united China, but at the same time, Washington de facto supported the speaker's decision to visit Taipei. Thanks to the hype that arose around the resonant visit of Pelosi, the greenback strengthened its positions in almost all dollar pairs. But this fundamental factor had a short-term impact on the dollar. Fortunately, the most pessimistic and even apocalyptic scenarios that were voiced by the press did not come true - China limited itself to military exercises around the island and the introduction of economic restrictions (blocked the import of certain goods) against Taiwan. Beijing also imposed personal sanctions against Nancy Pelosi. But despite the hysteria inflated in the media, no military clashes occurred.

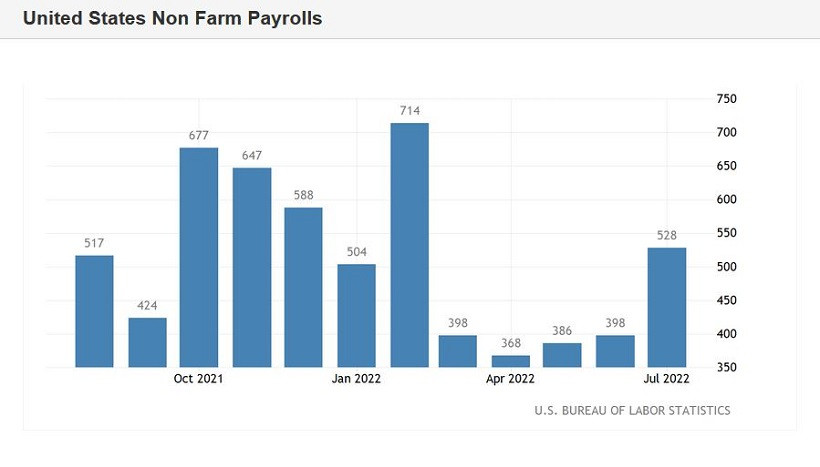

Therefore, the very next day after the visit, the dollar began to slow down. EUR/USD bulls seized the initiative, heading towards the upper border of the price range of 1.0130-1.0280. But another upward counterattack petered out at 1.0254 as bulls took profits ahead of the US labor market growth report. And not in vain. The July Nonfarm came out in the green zone: almost all the components of the release turned out to be better than expected.

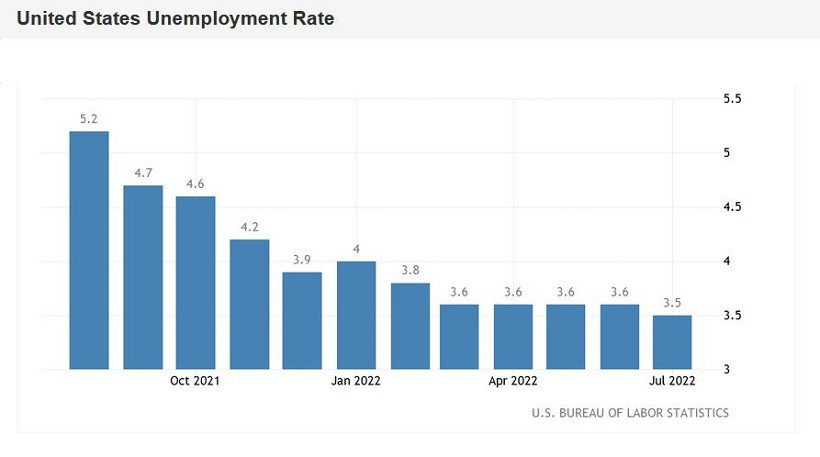

In particular, the unemployment rate in the United States still fell to 3.5%. Over the past four months, experts predicted a decline in the indicator to this mark, but it stubbornly remained at the level of 3.6%. The indicator dropped to 3.5% in March 2020 and in 2019 (that is, on the eve of the coronavirus crisis), and before that - 53 years ago, back in 1969.

And if the unemployment rate moved down minimally (relative to previous months), the other "headline" component of the release turned out to be surprising. Thus, the number of people employed in the non-agricultural sector jumped by 528,000 in July. Despite the fact that experts expected to see this figure at the 250,000th mark. Moreover, the June data was revised upwards: according to the final calculations, 398,000 jobs were created in the US instead of the previously announced 372,000. In the private sector of the economy, 470,000 new jobs were created in July, while the forecast was at the level of 270,000.

In general, the structure of the release suggests that the demand for labor in interest-sensitive sectors such as housing and retail has declined slightly, while airlines and restaurants, on the contrary, cannot find enough workers.

A separate line should be said about salaries. The growth rate of the average hourly wage on an annualized basis came out at around 5.2% (against the forecast of a decline to 4.9%). This is also a good result: the indicator showed a consistent negative trend for three consecutive months. And a decline was also expected in July. It was important for the dollar bulls that this indicator stay at least at 5.0% (or higher). As you can see, the result exceeded the expectations of most analysts.

Thus, the report allows the Federal Reserve to open a discussion on the rate hike in September by 75 points. At least the market has already started talking about the implementation of this scenario following the results of the next meeting in early autumn. Now it's up to inflation: the US consumer price index and producer price index will be published next week. If these reports also come out in the green zone, the dollar will again be "on horseback" due to the growth of hawkish expectations.

All this suggests that any more or less large-scale corrective growth of EUR/USD within the range of 1.0120-1.0280 should be used to open short positions. The downward targets remain the same: 1.0150 (with a rollback to the area of the second figure) and the area of 1.0110-1.0120.